Unknown Facts About Transaction Advisory Services

Wiki Article

The Buzz on Transaction Advisory Services

Table of ContentsEverything about Transaction Advisory ServicesThe 6-Minute Rule for Transaction Advisory ServicesThings about Transaction Advisory ServicesFacts About Transaction Advisory Services UncoveredThe 10-Second Trick For Transaction Advisory Services

This action ensures business looks its best to potential buyers. Obtaining business's worth right is important for an effective sale. Advisors utilize different techniques, like reduced capital (DCF) evaluation, comparing with similar business, and current purchases, to determine the fair market value. This assists set a reasonable cost and discuss successfully with future buyers.Transaction experts step in to help by getting all the required info organized, responding to inquiries from customers, and organizing check outs to the service's location. This constructs trust fund with customers and maintains the sale moving along. Getting the most effective terms is key. Transaction consultants use their competence to aid entrepreneur manage challenging negotiations, fulfill purchaser expectations, and structure bargains that match the proprietor's goals.

Fulfilling lawful guidelines is critical in any type of service sale. They help organization proprietors in planning for their next actions, whether it's retired life, starting a brand-new venture, or managing their newly found wealth.

Deal experts bring a wealth of experience and expertise, guaranteeing that every facet of the sale is handled skillfully. Via critical prep work, valuation, and arrangement, TAS aids entrepreneur accomplish the greatest possible sale price. By making certain legal and governing compliance and managing due persistance alongside various other deal employee, deal experts lessen prospective risks and responsibilities.

Transaction Advisory Services Can Be Fun For Anyone

By contrast, Big 4 TS groups: Service (e.g., when a possible customer is conducting due persistance, or when an offer is closing and the buyer needs to incorporate the firm and re-value the seller's Equilibrium Sheet). Are with charges that are not linked to the offer shutting effectively. Gain charges per interaction somewhere in the, which is less than what investment banks earn also on "small deals" (however the collection likelihood is also a lot greater).

The interview concerns are really similar to financial investment financial meeting concerns, but they'll concentrate more on audit and appraisal and less on subjects like LBO modeling. Anticipate concerns about what the Adjustment in Working Resources methods, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional just" topics like trial equilibriums and exactly how to walk via events using debits and credit reports instead of financial declaration changes.

The Ultimate Guide To Transaction Advisory Services

Specialists in the TS/ FDD groups may additionally interview administration concerning everything over, and they'll compose a detailed record with their findings at the end of the procedure., and the general form looks like this: The entry-level role, where you do a great deal of information and financial evaluation (2 years for a promotion from here). The following level up; comparable work, but you obtain the even more interesting bits (3 years for a promo).

Specifically, it's hard to obtain promoted beyond the Supervisor degree due to the fact that couple of individuals leave the work at that stage, and you need to start showing proof of your capacity to generate profits to advancement. Let's begin with the hours and way of life given that those are easier to describe:. There are occasional late nights and weekend job, however nothing like the agitated nature of investment banking.

There are cost-of-living adjustments, so expect lower compensation if you're in a cheaper area outside major economic (Transaction Advisory Services). For all placements except Partner, the base salary comprises the mass of the overall settlement; the year-end incentive could be a max of 30% of your base pay. Often, the very best means to raise your revenues is to switch over to a different firm and browse this site discuss for a greater income and reward

The smart Trick of Transaction Advisory Services That Nobody is Discussing

You could enter corporate advancement, but investment banking obtains harder at this phase since you'll be over-qualified for Expert functions. Business money is still a choice. At this stage, you should simply remain and make a run for a Partner-level function. If you intend to leave, maybe move to a client and perform their valuations and due diligence in-house.The main problem is that because: You typically need to join another Large 4 group, such as audit, and work there for a few years and after that relocate right into TS, job there for a couple of years and afterwards move into IB. And there's still no warranty of winning this IB role since it depends upon your area, customers, and the hiring market at the time.

Longer-term, there is also some danger of and since examining a company's historical economic details is not specifically rocket scientific research. Yes, people will certainly always need to be entailed, yet with advanced technology, lower head counts might possibly support client interactions. That said, the Transaction Services group beats audit in regards to pay, job, and departure chances.

If you liked this post, you could be thinking about analysis.

4 Easy Facts About Transaction Advisory Services Explained

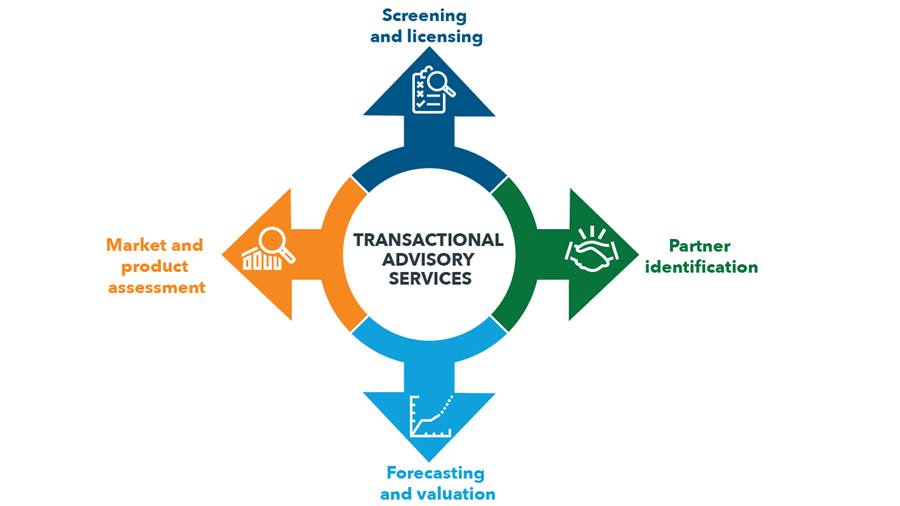

Establish advanced financial frameworks that help in determining the real market price of a company. Supply consultatory job in connection to service valuation to aid in bargaining and rates structures. Explain the most ideal kind of the offer and the kind of consideration to utilize (cash money, stock, make out, and others).

Create action plans for threat and exposure that have been identified. Carry out assimilation preparation to figure out the procedure, system, and business changes that might be required after the offer. Make numerical estimates of integration expenses and advantages to evaluate the financial rationale of integration. Establish guidelines for integrating divisions, modern technologies, this contact form and organization procedures.

Evaluate the possible client base, industry verticals, and sales cycle. The functional due persistance provides crucial insights into the functioning of the firm to be acquired worrying threat evaluation and value production.

Report this wiki page